DCL’s 3 year premium stability plan, now enjoying its second decade of use, was updated in 2018 to include a revised maximum discount of 20%.

Whilst over the years the T20 has seen some changes, the core principals remain and nearly half of all DCL clients now choose to protect their finances by opting in.

The T20 is a separate overarching agreement covering 3 annual contracts of insurance.

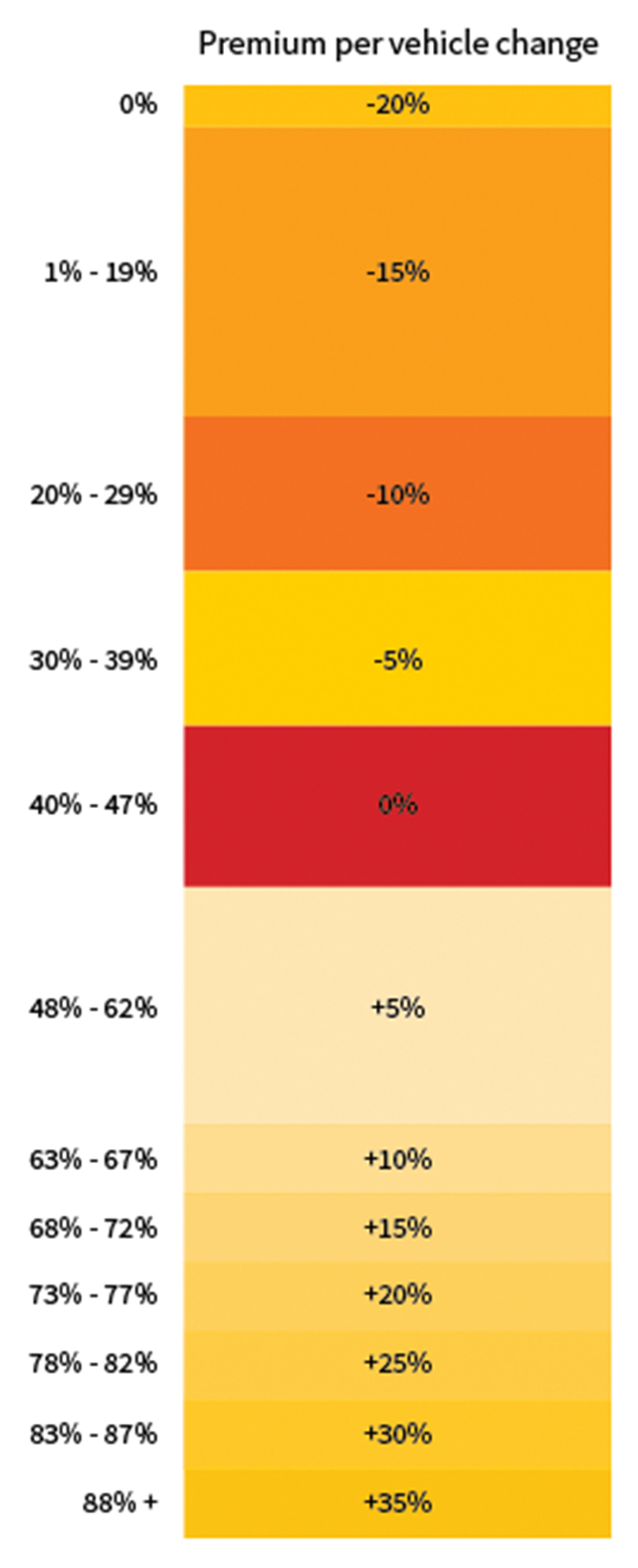

Pricing for the 2nd& 3rdyear are calculated by way of a pre-set adjustment scale which is linked directly to the loss ratio of the fleet. This means clients can enjoy fixed pricing for three years allowing for effective cash flow forecasting.

With no need to go to market and clients paying a premium reflective of the performance of their fleet, clients (& their brokers) signing up to a T20 save time and consequently money over the 3 year period.

The T20 is DCL’s alternative to a low claims rebate and allows clients to see the benefits of reducing claims and costs more quickly. In addition, the reductions compound which a normal LCR cannot provide.